Spring is approaching, and with it the recurring discussions about negative prices on the electricity exchange on sunny and windy days. At Easter and Pentecost, they have almost become the norm. The low-price season lasts from April to August. The number of hours with negative electricity prices has increased significantly in recent years. In 2023, the price of electricity on the day-ahead market was zero or below for 301 hours. In 2024, this figure had already risen to 459 hours. What this means for the ever faster changing energy system will be a key topic when the industry meets at EM-Power Europe from May 7 to 9, 2025. The International Exhibition for Energy Management and Integrated Energy Solutions is part of “The smarter E Europe”, Europe's largest exhibition network for the energy industry, and will take place concurrently with three other exhibitions: Intersolar Europe, ees Europe and Power2Drive Europe.

First of all, it should be noted that negative electricity prices are not a disaster. Rather, they show that the electricity market is working. This is because the supply of climate-neutrally generated electricity from renewable sources exceeds current demand. This is both a signal and an incentive to shift electricity consumption from the grid to these times. At the same time, however, they also signal an asymmetrical development in recent years. The expansion of solar power generation has progressed rapidly. At the same time, the development of flexible consumers and storage facilities has been comparatively slow. This discrepancy must not become a permanent condition. Supply and demand must be reconciled again.

Storage is part of the solution

One obvious solution is to buy electricity when prices are low or even negative and store it. This means that it can be fed back into the grid at a later time when demand is high and prices are correspondingly high. The necessary storage capacities are being greatly expanded worldwide. In Germany, large-scale storage facilities with a total capacity of around 2.5 gigawatts are currently in the planning stage, according to the market master data register of the Federal Network Agency. The connection requests to the four German transmission system operators are many times higher.

According to a survey by PV Magazine, at the turn of the year there were 650 follow-up requests with a total capacity of 226 gigawatts. It is not known how many of the requested projects will actually be realized. However, Thomas Dederichs, Head of Strategy and Energy Policy at transmission system operator Amprion, is already talking about a “tsunami of connection requests”.

Flexibility on the part of consumers

At least as important as the expansion of storage is the potential for flexibility. This applies to both consumers and the control of processes in industry and commerce. Private households have considerable potential to be active in the electricity market. By operating private solar systems, many of them have already been transformed from pure consumers with a largely fixed load profile to prosumers. Combined into controllable swarms, many wallboxes, batteries and heat pumps could become real players in the electricity market. Market players such as the companies sonnen and Lichtblick have already developed corresponding business models.

Potential for flexibility also exists in trade and industry

The potential in trade and industry is just as important, even if it is more difficult to grasp. Which processes can really be made more flexible, to what extent and under what conditions varies from company to company. This requires individual planning. Whether and when, for example, loads should be increased or reduced and how long the lead time is varies greatly. However, it can have a significant impact. For Germany, the Copernicus project “SynErgie” concludes that industrial companies could reduce their load on demand by up to 3.3 gigawatts for 15 minutes. The power taken off could be increased by 1.5 gigawatts over this period.

Power generation costs in Europe could be reduced by €4.6 billion

The European industry association “smartEn” has calculated the impact of making all market participants more flexible: According to the association, comprehensive integration of all technical flexibilities into the market could reduce power generation costs in Europe by €4.6 billion and at the same time reduce the curtailment of renewable energies by 61 percent. Michael Villa, Executive Director of smartEn, explains: “Activation of flexible demand is a strategic priority to increase the access to affordable energy prices for all consumers and specifically improve the competitiveness of industries in Europe. We cannot rely on geopolitical dynamics to reduce energy prices: flexible demand can achieve this objective in the short-term while also providing extra remunerations to those participating in flexibility schemes.”

EM-Power Europe shows the way to integrated energy solutions and stable power grids

EM-Power Europe offers a comprehensive overview of the current state of technologies and solutions for the necessary large-scale creation and provision of flexibilities. Innovators, decision-makers and practitioners will meet in Munich to present products, services and business models for integrated energy solutions and stable power grids, and to discuss future trends and dynamics.

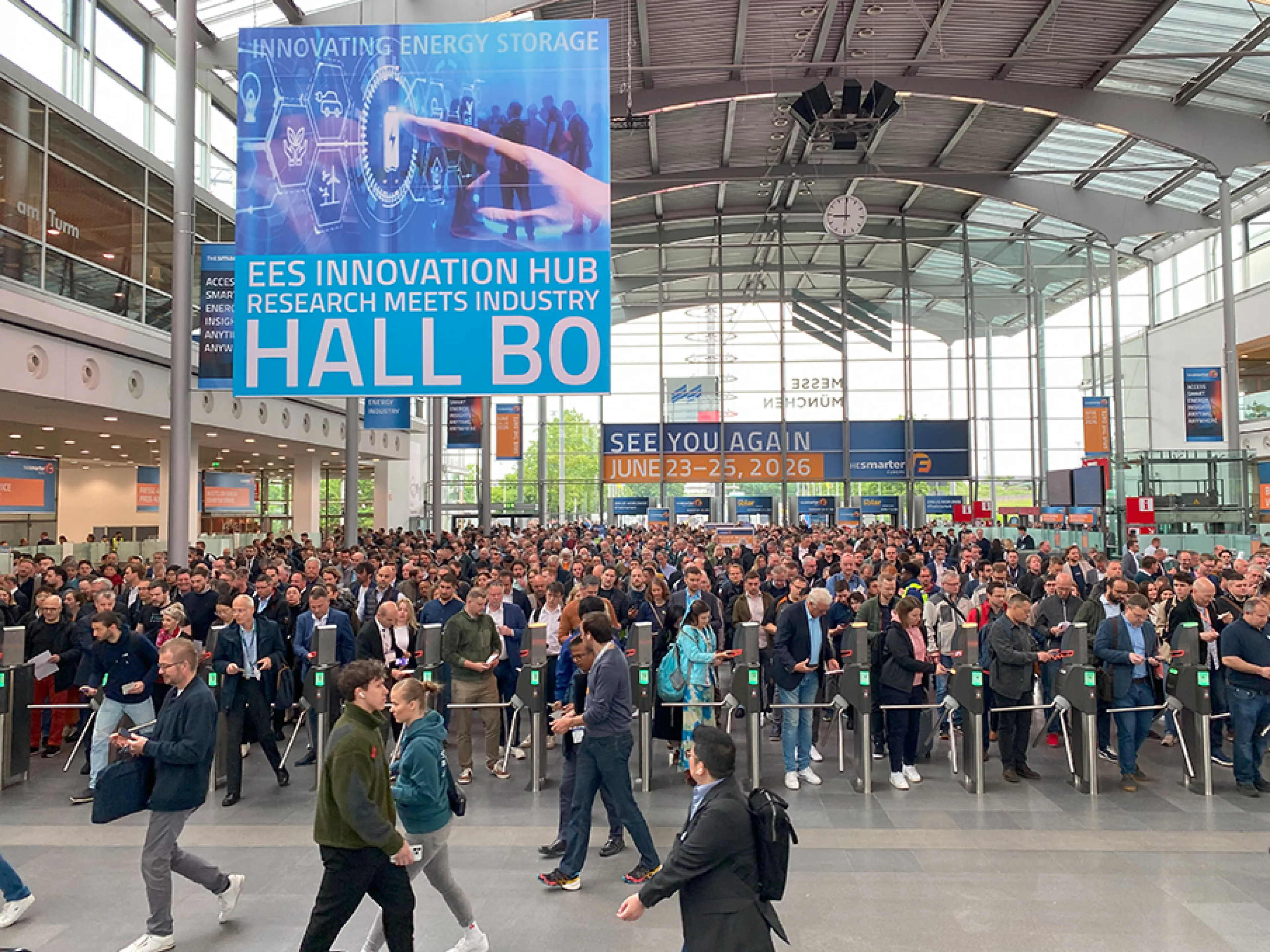

The organizers expect more than 3,000 exhibitors and over 110,000 visitors to attend the four sub-trade fairs of “The smarter E Europe” on a total of 206,000 square meters in the 19 halls and outdoor area of the fully booked exhibition center in Munich. The topic of flexibility will also be given plenty of room and weight in the events and sessions of the EM-Power Europe Conference and the The smarter E Forum.

Trade fair for energy management and networked energy solutions

EM-Power Europe is the international exhibition for energy management and networked energy solutions. Under the motto “Empowering Grids and Prosumers”, it brings together grid operators, energy suppliers and municipal utilities, project developers, installers, energy consultants, managers and service providers. The focus is on current trends and developments for a holistic, renewable energy system, from the modernization, digitization and flexibilization of the power grid to the smart grid and the integration of prosumers, e-mobility and power-to-heat.