Schneider Electric announced its first quarter revenues for the period ending March 31, 2020. Q1 revenues reached €5,830 million, down -6.4 percent organically. Across the group in Q1, products were down -6.2 percent organically., largely due to Covid-19 impact in Asia Pacific. Commercial & industrial buildings (CIB) was down while offers for residential & small buildings showed a slightly better performance. Demand from discrete industrial markets dropped across both industrial automation and energy management. Systems (projects and equipment) decreased by -13.1 percent organically, reflecting the high base of comparison in Q1 2019 coupled with impact of Covid-19 and commodity market volatility, impacting both businesses. Software & services grew 3.4 percent.

Schneider Electric continued to see traction in its software and service offers across end markets including specific wins linked to smart grids, cybersecurity and sustainability. The group’s digitally enabled offers based on analytics to enable remote monitoring, preventive maintenance and asset management for higher efficiency saw increased traction. Field Services grew with an increased focus through the crisis towards electro-intensive customers supporting mission-critical infrastructure. Aveva contributed to the growth despite its ongoing shift towards subscription and a high base of comparison.

Jean-Pascal Tricoire, Chairman and CEO, commented: “Today we are all facing a global health and economic crisis. At Schneider, we enter this crisis with solid fundamentals. We have a consistent strategy that is delivering resilience, efficiency and sustainability for customers in our four end-markets. We started Q1 on a positive note across the world, with the exception of China that was impacted by the crisis. As we end the quarter, large parts of the world are in some form of lockdown while China starts its recovery path. As we navigate through the multiple lockdowns and put in place the necessary measures to weather the crisis, we also plan for the times ahead remaining very mindful of our mission and larger purpose with a view to prepare the future post crisis.”

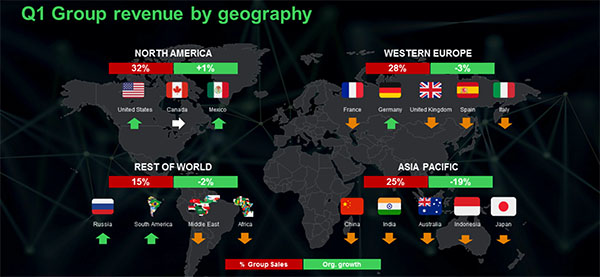

The breakdown of revenue by business and geography was as follows:

Energy management sales fell -6.1 percent organic (largely in Asia Pacific led by China). The fall in activity, as a consequence of the Covid-19 crisis, in residential and CIB end-markets varied from country to country with some projects restarting after appropriate health & safety measures were put in place, while some governments stipulated that non-essential construction must remain on hold. Hospitals, food chain and life science projects continued while hotels, leisure and shopping malls were directly impacted. Data center was down on a high base of comparison in the quarter. The group saw growth in its distributed secure power offers that support power back up, including for “working from home” networks. Sales to industrial end markets were down in the quarter. Services performed well in specific segments such as consumer packaged goods and transportation. The group’s ecostruxure offers, especially for applications enabling remote monitoring, virtual testing and commissioning, preventive maintenance and servicing in mission critical and essential sites, gained traction. The product offerings from Asco Power for automated transfer switching coupled with specific MV/LV and secure power offers including software, remain essential to ensure continuity of operations in critical infrastructure.

Industrial automation sales fell -7.3 percent organic. The results reflected the evolution of the economic cycle coupled with the impact of the Covid-19 crisis. Discrete as well as process & hybrid markets were down with process & hybrid faring relatively better given its mid-late cycle nature. Certain segments proved more resilient including, Transportation, consumer packaged goods, utilities and water & wastewater. Software and digital services proved resilient and continued to grow.

The group has built its digital capabilities over several years focused on its connected offers complemented with its suite of software and digital services. The group has also been focused on enhancing the digital customer experience as a key element of its digital transformation while establishing communities and partnerships. In Q1 2020, the company has witnessed an increased level of interest by customers for digital services linked to remote monitoring, asset performance and predictive maintenance. Assets under management grew more than 40 percent year-on-year in Q1. The group also provided multiple digital interactions and trainings to customers across the world.

The supply chain organization has instituted a global crisis management team that is tracking developments in real time. While the first initiatives included ensuring the health & safety of its employees, the group also adapted some facilities to assist in the production of essential medical equipment including ventilators and 3D design/printing of masks/face protection.

At the same time, the group ensured that products & services for critical industries remained available. The supply chain organization is monitoring factory and distribution center manpower availability with China presently at full manpower capacity and other regions at differing levels of manpower capacity primarily compatible with demand.

In keeping with its strategy to enhance digital content within its offers, Schneider Electric announces the signing of an agreement for the acquisition of Proleit. This bolt-on acquisition enhances the group’s offering in the consumer packaged goods segment with a specific focus on food & beverage, chemical and life sciences. Proleit offer of industrial automation process control will be integrated into the group’s Ecostruxure plant offering (within its Industrial Automation business) and will seamlessly communicate with Aveva software to add value for customers. The transaction is expected to close in the coming months.